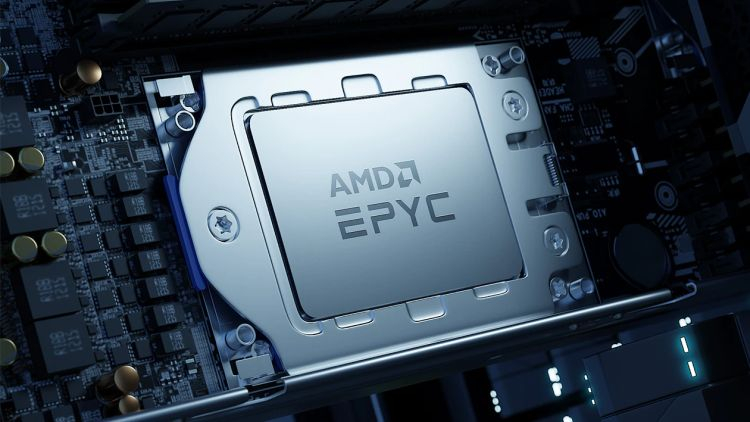

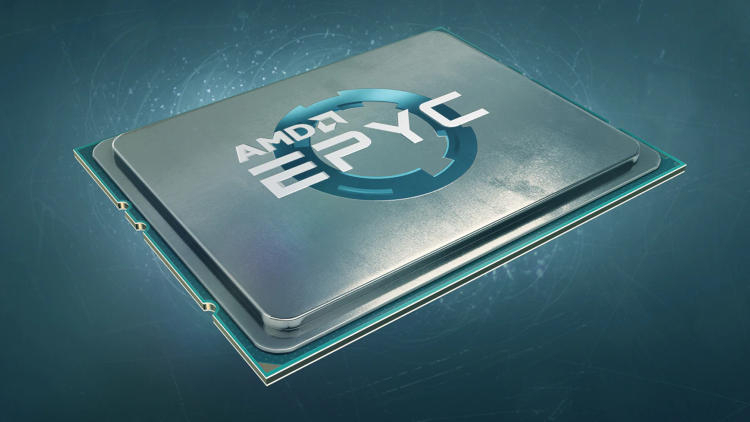

AMD will unveil next-generation EPYC server processors on the evening of November 10.The company officially announced this on its website.The manufacturer did not indicate which series the new chips will belong to, but it is very likely that we are talking about EPYC Genoa processors.Image source: AMDIt is currently known that EPYC Genoa processors will be able to offer up to 96 physical cores on the Zen 4 architecture with support for up to 192 virtual threads.AMD is going to release a wide range of chips with different numbers of cores.The minimum is unknown, so let's just note that the current EPYC Milan series includes models with the number of cores from 8 to 64. We also know from leaks that EPYC Genoa processors will get 1 Mbyte of L2 cache per each core.L1 cache size is 32 Kbytes for instructions and data, L3 cache size - 4 Mbytes per each core.New processors will be launched together with new AMD Socket SP5 platform (LGA 6096).The new processor socket will support 12-channel DDR5 RAM controller and PCIe 5.0 interface.AMD will present new EPYC processors during live broadcast starting at 20:00 PM Moscow time on November 10.You will be able to watch it on AMD website or on official AMD YouTube channel.