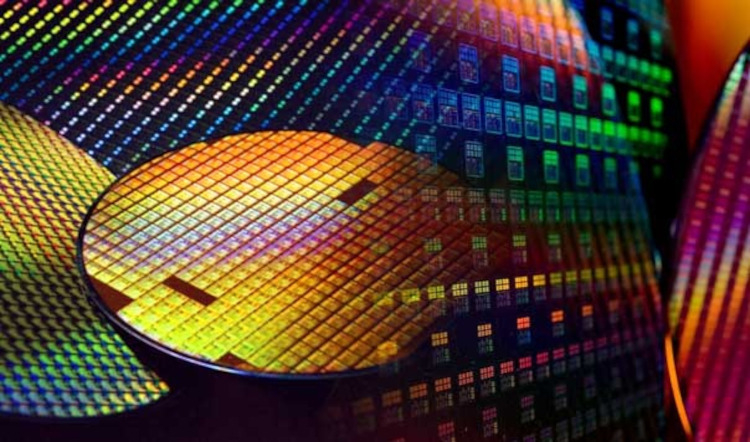

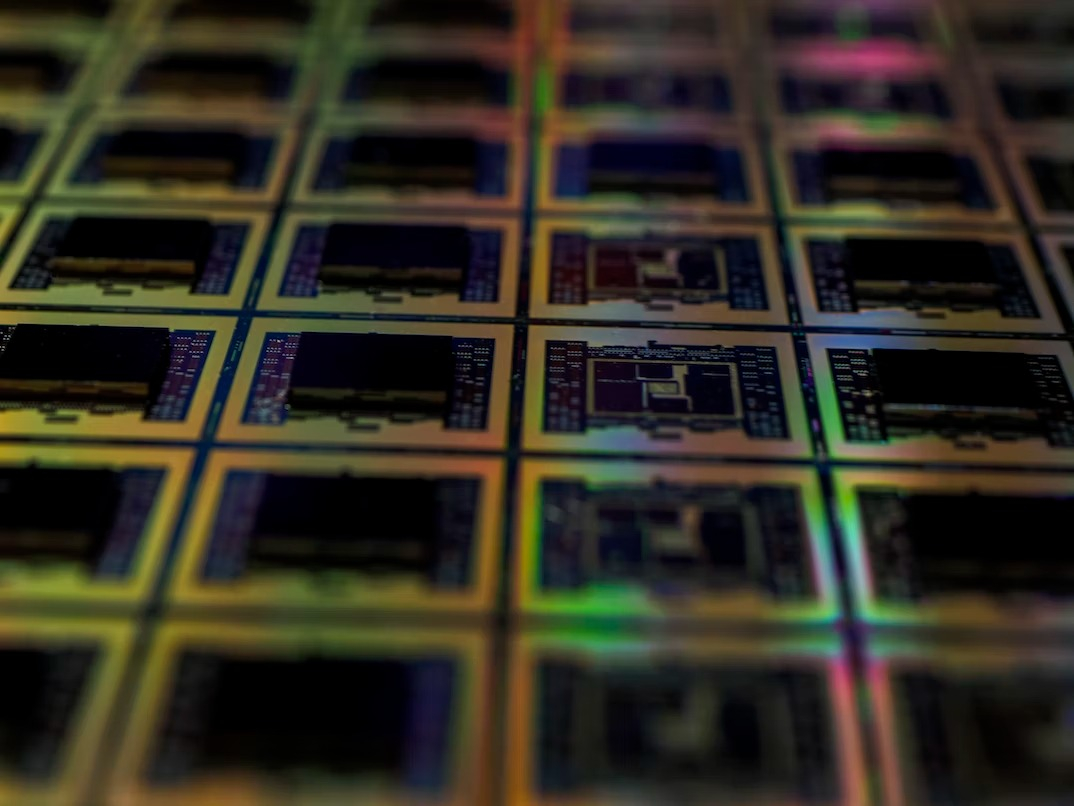

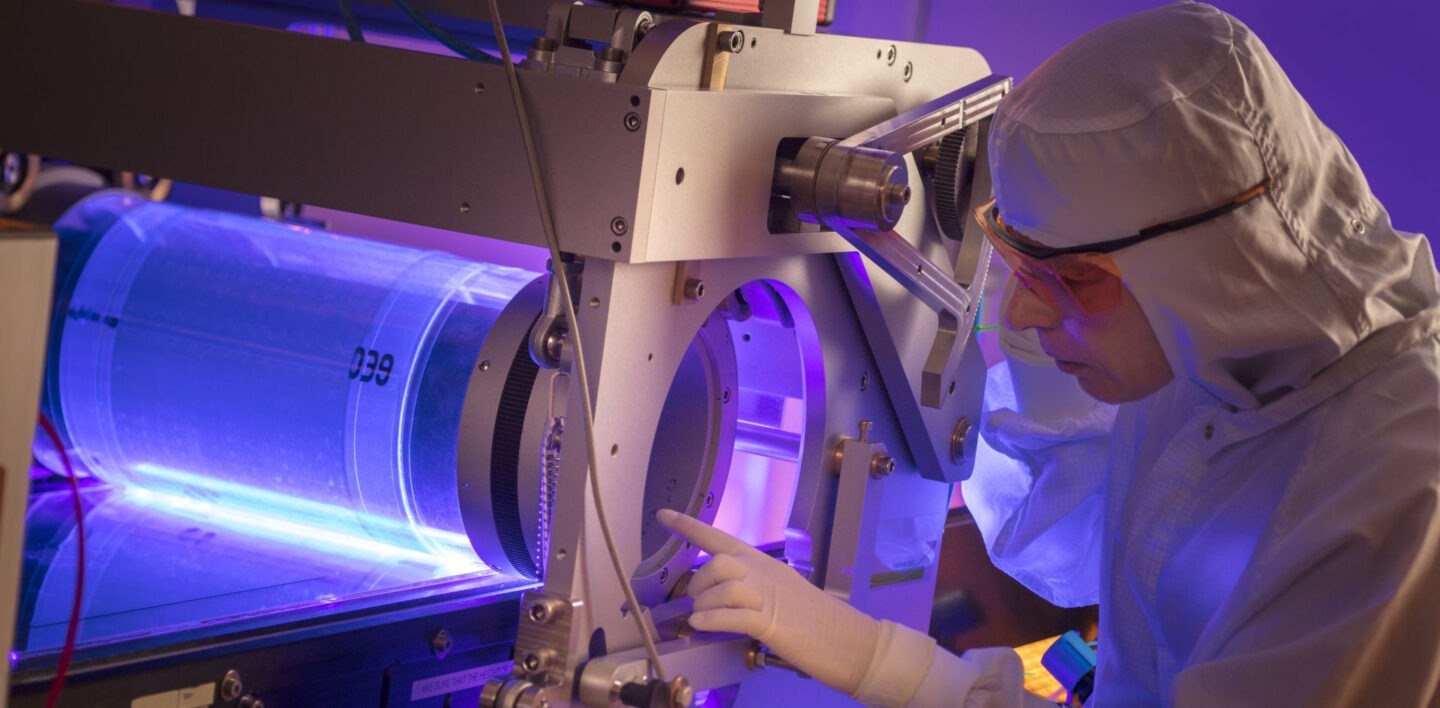

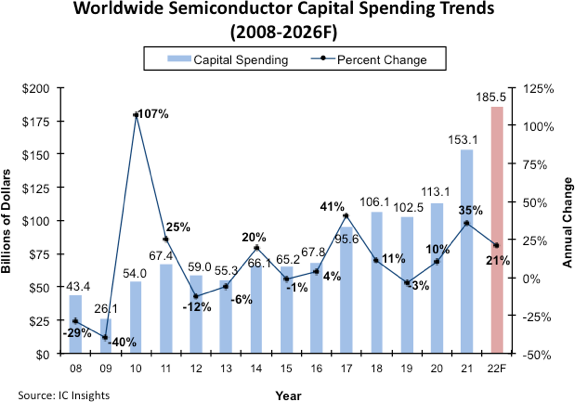

Recently, news about a total chip shortage has been replaced by information about a mitigation of the situation.What's more, some reports suggest that TSMC is asking its employees to take a leave of absence as computer makers have noticeably reduced orders, and orders from smartphone makers have declined even further, a trend that will continue into 2023.Meanwhile, while some manufacturers are not experiencing any shortage of semiconductors, many companies are still suffering from acute shortages.Image source: МicronAs Forbes reports, while TSMC's leading customers - Apple, AMD, Intel, MediaTek, NVIDIA, and Qualcomm are constantly developing more and more advanced processors, they are currently very \"conservative\" about sales forecasts and, therefore, production orders.In other words, the leading electronics component vendors do not need many chips yet.This is not surprising, because in this sector demand is largely determined by demand for PCs, which, according to Gartner, in April 2021 rose to record levels, sales of the top six PC manufacturers grew at a double-digit percentage rate, and for some time, even triple-digit sales of Chromebooks.This trend could not last forever, and figures have already appeared on the sale of certain models of Chromebooks for literally $79 (in the US) - even components for them cost more, but the market is already crowded, and demand is satisfied for almost years to come.At the same time for the release of new models manufacturers have to free up their warehouses from old and expect high demand for components in this segment in the foreseeable future is not necessary.For example, in its latest earnings report Micron Tecnology reported that demand in the calendar year 2022 will on average be lower than supply, which will lead to a build-up of large stocks in the warehouses of suppliers.Scarcity typically initiates massive investments in building new capacity and mastering new process technologies, resulting in the occasional oversupply crisis.Surplus is observed in many industries-but not in all.In particular, there is no abundance on the market of chips for cars.The point is that most of the semiconductors for cars are produced according to the so-called \"mature\" process technologies, and most of the demand is for 90-nm semiconductors.These were considered the most advanced solution around 2002, 20 years ago.Nevertheless, they are quite in demand, since many components simply do not need ultra-modern technology, and the process of transition to it is costly and long.Image source: BMWFactories continue to use the old tools for production and, since this segment is not the most profitable, for most manufacturers there was no need to invest in new capacity.Such semiconductors weren't quite enough already by the beginning of the pandemic, and 2020 recorded about an eight-week period in which most auto factories had to partially or completely suspend operations due to sanitary restrictions, after which they withdrew their semiconductor orders.Meanwhile, explosive growth in other sectors requiring chips has put \"obsolete\" production capacity to full use, and as Forbes reports, when automakers tried to restart orders, delivery times for them catast