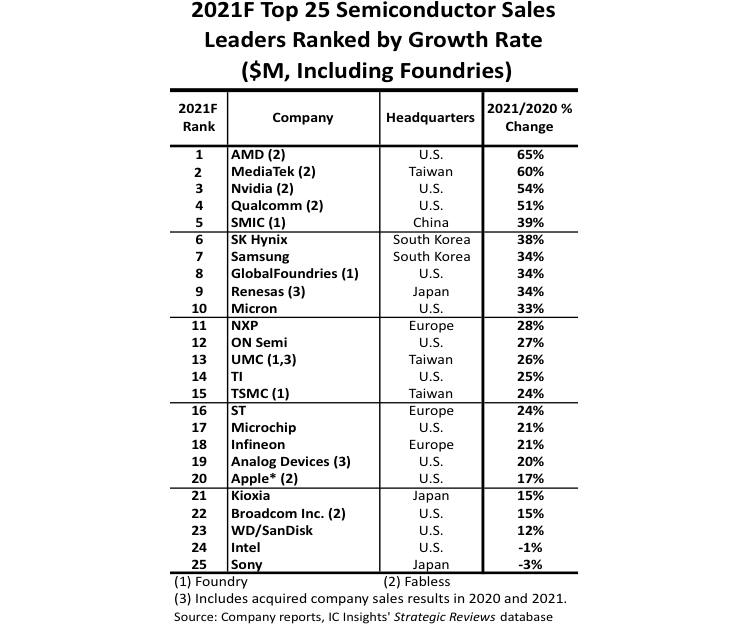

IC Insights analysts published revenue growth forecast among chip makers by the end of 2021. The list is topped by AMD, which is expected to post 65% year-over-year revenue growth. According to analysts, the company has excellent results in all markets, including consumer, professional and high-performance computing market & ; and this applies to both central and graphics processors.

The overall numbers indicate clear growth in the industry as a whole, with an average increase in revenue of 23 %. This figure is made up of a 20 percent increase in shipments (number of sales) and a 3 percent increase in average selling price (ASP). That pace has not been faster since 2010, when the electronics components industry grew 33% year-over-year following the global recession of 2008–2009. The outsiders of the rating are Intel, whose revenue in 2021 may fall by 1 %, and Sony, which can lose 3 %. The first place in the list was taken by AMD, which was predicted to grow by 65 %. The company managed to take a comfortable place in the consumer market, but the explosive increase in its revenues is associated with the growth of the average selling price: the company conquered the server market with EPYC processors. In the segment of high-performance computing, the number of systems on AMD platforms has doubled: in the TOP500 supercomputer ranking there are 49, compared with 21 in 2020. The second place in the ranking of revenue growth forecasts was occupied by Taiwanese MediaTek with the result of 60 %. Third was NVIDIA (54 %), fourth & ; Qualcomm (51 %), fifth & ; SMIC (39 %). Here it is worth noting that the first four places out of five went to chipmakers without their own production facilities. At the same time Taiwan TSMC, which is now considered the most powerful player in contract manufacturing, closes the third five with a growth forecast of 21 %. WD & ; only 12 % is the smallest positive indicator.

The first with lquo;negative growth» was Intel, which IC Insights analysts predicted a decline in revenue by 1 % compared to 2020. Even the new program IFS (Intel Foundry Service), in the framework of which the company decided to start contract manufacturing of components for other market players, could not help to avoid a negative result. Intel now has a lot of problems: it is being squeezed by AMD, NVIDIA and Arm from different fronts, and has to reckon with the decline in supply and change the strategy. At the same time, the company's projected revenue for 2021 is $77 billion, which is still significantly different from AMD at $15 billion. The last in the list was Sony, the revenues of which may fall by 3 % in 2021, despite the fact that PlayStation 5 is not stale on the shelves. The Japanese company could not offer anything solid against the global shortage of semiconductor components and the high demand for its products & ; as a result, it had to reduce the forecast for the production of consoles by 1 million units until March 2022. Judging by IC Insights, the semiconductor market is experiencing a surge in growth not seen in 11 years. It's encouraging that this is coming at the expense of increased shipments rather than ASPs, boding well for the consumer and professional markets.

0 Comments