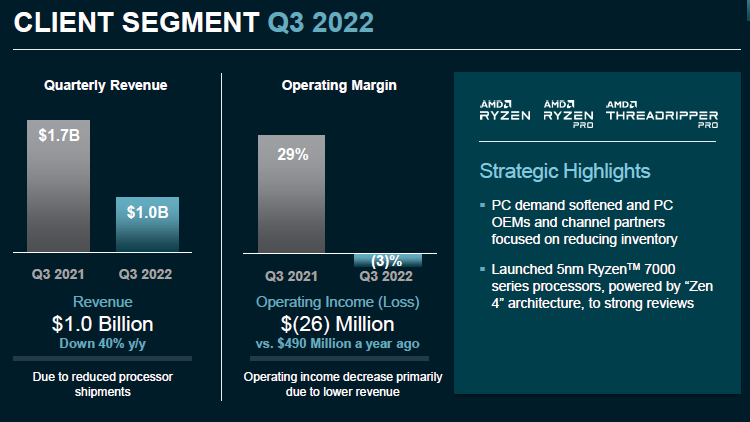

AMD quarterly report was released a few hours ago, and in terms of revenue dynamics only slightly disappointed analysts, who were ready for the loss of the former momentum of the PC market.The company's total revenue was up 29% year-over-year, but in the consumer segment it collapsed by 40% due to Ryzen processors, and had to end the quarter with operating losses in this area.Image source: AMDNet revenue for AMD fell 93% to $66 million, but the company attributes this to the costs associated with the Xilinx takeover deal.At the end of the quarter AMD's revenue was $5.6 billion, and while a 29% increase in annualized terms cannot be characteristic of previous quarters, it still looks decent against the backdrop of competitors.Profit margin decreased during the year from 48% to 42%, operating expenses increased by 113% to $2.43 billion, and the quarter ended with an operating loss of $64 million.The company explains this by the growth of expenses on research and development, as well as by the consequences of the Xilinx takeover deal.Due to the need to reduce inventories and review product prices in the past quarter AMD lost at least $ 160 million.Image source: AMDAs the head of the company Lisa Su (Lisa Su) said at the conference call, \"the third quarter was worse than we expected because of the deteriorating PC market and a significant correction of inventories in the supply chain in this segment.In fact, the value of inventory at the end of the quarter increased 77% to $3.37 billion.Even in such a difficult environment, the CEO added, the company managed to increase revenue in the data center, embedded and gaming solutions segments.At least in the area of game consoles there was a positive trend.Image source: AMDIn the segment of data centers revenue grew by 45% year on year to $1.6 billion due to the popularity of central processors EPYC family.Operating profit rose from $308 million to $505 million, and the operating margin rose from 28% to 31%.The past quarter was AMD's tenth consecutive quarter in which its server processor sales volumes in cash terms broke a record.EPYC processors of new Genoa generation are in high demand, as pointed out by AMD, although their formal announcement is only scheduled for November 10.Shipments of Xilinx Programmable Matrixes and Pensando Computing Accelerators are up noticeably.Lisa Su said she expects revenue growth in the server segment next year, especially cloud solutions in the U.S., but the Chinese market will be weak.Image source: AMDIn the client segment, AMD saw a 40% drop in revenue to $1 billion compared to the same quarter last year.Processor shipments declined due to inventory surpluses while demand in the PC market declined, all of which resulted in an operating loss of $26 million in the segment.Nevertheless, the shift in the supply mix in favor of the more expensive Ryzen desktop models allowed the average selling price to increase year-over-year.The company only needs to add that the Ryzen 7000 processors with Zen 4 architecture introduced in the last quarter received praise in published reviews.By the end of 2023, according to Lisa Suh, the capacity of the PC market should shrink by 10%.This year, the market will shrink by the full 20%.Image source: AMDIn the gaming segment, which recently includes both graphics cards and components for gaming consoles, AMD managed to increase revenues by 14% year-on-year to $1.6 billion.While revenues in the direction of graphics cards declined, gaming consoles provided a positive trend, partially compensating for this.In fact, gaming console components have been breaking revenue records for six consecutive quarters.Operating profit in this segment fell from $231 million to $142 million.The company had to generate less revenue from graphics solutions and faced increased inventory, as well as downward price adjustments.The operating profit margin dropped from 16% to 9%.Gaming consoles were in high demand because of Microsoft and Sony's preparations for the new season.On the profile slide of the presentation AMD also did not forget to mention the preparation for the announcement of graphics solutions generation RDNA 3 with chips produced by 5nm technology.Novelties are to significantly increase performance compared to current generation products.As expected, they will be presented this week.AMD's revenue in the segment of embedded solutions grew by an impressive 1549% to $ 1.3 billion as a result of changes in the accounting structure and the acquisition of Xilinx at the beginning of the current

0 Comments