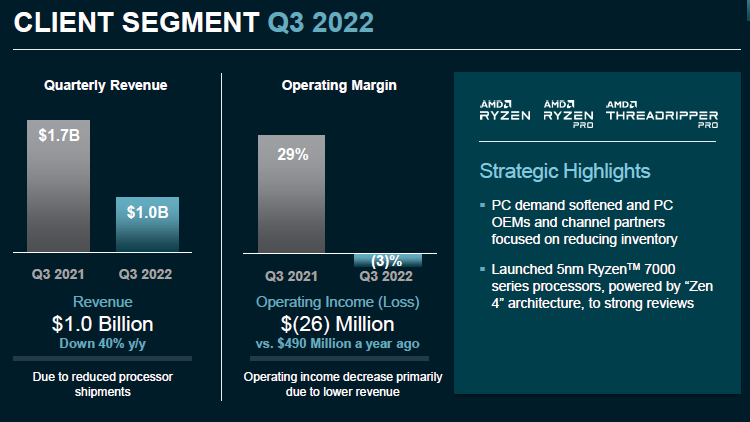

AMD quarterly conference revealed that the company's revenue in the consumer segment on the background of declining demand for new PCs decreased by 40% compared to the same period last year.At the same time, the trends in which the market is developing at the moment are not so unambiguous as to characterize them by any single definition.It is only clear that now the market is falling, but recovery is not far off, believe AMD.Source image: AMDFirst, AMD CEO Lisa Su (Lisa Su) explained that revenue in the client area in the third quarter decreased, among other reasons, due to lower number of processors sold.Their average selling price also declined in a sequential comparison, as more expensive processors were depleted faster in terms of inventory.In year-on-year comparisons, the average selling price went up, and this can be explained by the continuing tendency to shift the focus towards more expensive models.The head of AMD even added that the company's position is strong in the premium, gaming and corporate customer market segments, and it expects to strengthen its position in these areas going forward.In the long term, the price structure of AMD products supply in the client segment should not change, as the head of the company is convinced.As noted earlier today, AMD management expects to reduce the number of computers sold in the whole market by 20% this year, and next year's decline will be limited to 10%.The company will continue to actively get rid of inventory in the fourth quarter, and this process is somewhat accelerated in a sequential comparison, and in general by the end of the year AMD will be in better shape, but it should be understood that the revenue in the current quarter slightly reduced in the client segment, as well as in the gaming.In the latter case, such dynamics can be explained by the fact that the peak demand for components for gaming consoles occurred in the third quarter, and in the fourth quarter it traditionally declines.New gaming video cards with RDNA 3 architecture, which will be presented this week, though will be able to revive the market in the fourth quarter, losses from the decline in demand for game consoles components will not be able to cover.But next year AMD expects to maintain revenue in the gaming segment at the level of the current year, which, given the high base effect formed by the last stages of the cryptocurrency boom is quite optimistic.In general, speaking of the PC market, AMD management expects to overcome major problems in the current quarter and early next year, and the rest of 2023 should already contribute to the PC market recovery, according to Lisa Su.In the customer segment, she promises to introduce some new products (most likely the new Ryzen 7000), which, combined with the recently announced Ryzen 7000 processors, will help revive interest in the brand's products.Moreover, at retail, even in the third quarter, sales volumes of Ryzen 5000 processors grew, according to Lisa Su, but only when it comes to desktop models.With the expansion of the range of motherboards with socket AM5 more affordable models in the current quarter will increase the popularity of the new family of Ryzen 7000 processors, as the company's management expects.AMD is not ready for the aggressive pricing policy for the sake of reducing the inventory, because it is important for it to maintain the profitability indicators.Last year, for example, the company did not fight for the segment of Chromebooks, because it was based on too cheap processors, the release of which was unprofitable for the company.